Credit Tips

6 Reasons to Be Thankful for Good Credit

This week, we take time out to count our blessings and be thankful for the good fortunes in our lives, big and small. Sometimes there are “hidden” blessings that we may not consider too often, but that tend to be beneficial in our every day lives. If you have top tier credit, either by practicing…

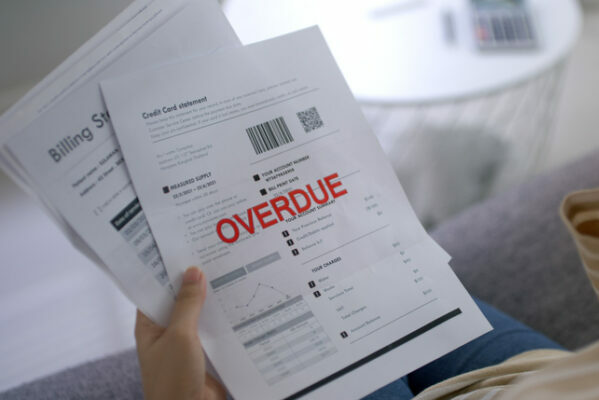

Read MoreWhy You Should Take Action to Remove Mortgage Lates from Your Credit Report

The pandemic and job losses that followed caused millions of Americans to be late on mortgage payments. In some cases it may have been just one late payment, in other cases it was multiple late payments or what is commonly called “rolling” late payments. If those derogatory lates are still on your credit report,…

Read MoreBeware of These 4 Red Flags of a Credit Repair Company

For most people, credit repair is a bit of a mystery. We even discussed the credit repair mystery in previous articles. While our process is time-tested and proven, there are still many credit repair companies out there who tend to mislead people with their advertising. There are very strict Federal laws that all credit repair…

Read MoreThe Dream of Home Ownership CAN Be Your Reality!

We invite you to join us at 6:00pm on November 9th as we have been humbly asked to team with local real estate leaders in presenting a “Zoom and Learn” workshop on home ownership! We’ll cover important topics such as market stability, credit considerations, and lending guidelines. All are welcome to attend as this is…

Read MoreCredit Repair: It’s Not a Mystery, It’s a Process

Sometimes, when people hear about credit repair and the stellar results we tend to get, there is a “too good to be true” attitude – and we understand why. The results we achieve sometimes to seem like they are too good to be true and therefore, the assumption is that we must be exaggerating, doing…

Read MoreWhat Is the Difference Between Credit Repair and Debt Consolidation?

Low credit scores can come from a number of things such as late payments, collections, not having enough credit, too much debt, etc. But sometimes consumers aren’t sure if they should look into credit repair or debt consolidation in an effort to get their finances back into shape. If you find yourself in this position,…

Read More