Did You Overpay for Your Last Car?

We’ve all seen the car commercials advertising those insanely low car financing rates like 0.9% or sometimes even 0%, but the fine print will tell you that very few people get those loans because not only does your credit need to be perfect, but you also have to be willing to finance your car for 2 or 3 years, as opposed to the normal 5 or 6 year loan term.

Instead, let’s talk about scenarios that play out every single day at every single car dealership…

Assume for a moment that you have had your eye on a beautiful new car with a sticker price of $50,000. You’ve used your expert negotiating skills to beat the dealer down to $42,000. You agree to put $5000 down, which brings you to $37,000, and then after taxes, license, and fees, and you’re left with roughly $40,000 that needs to be financed. So far, so good.

Now the sales person disappears for a few minutes while he/she talks with the finance manager before magically re-appearing with your monthly payment in hand.

So what just happened?

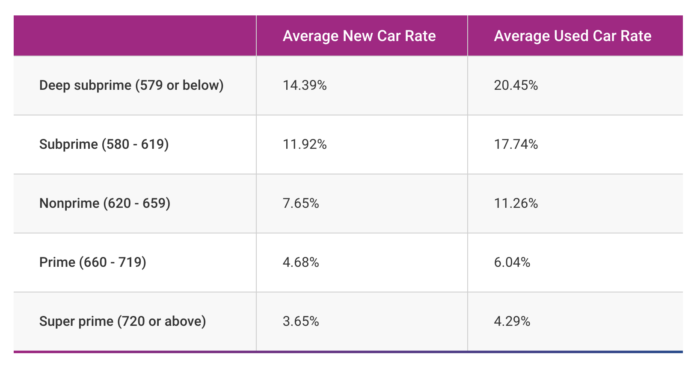

Well, the finance manager ran your credit and then determined your loan terms based on your credit score. The loan rate you received was based heavily on your credit scores. According to Experian, here’s a snapshot of recent average car loan rates.

If you have great credit (720 or higher) the salesperson should have come back with a 5 year payment around $730/mo. But if your credit was just average (around 650), that payment was more like $805/mo. Yes, you can still qualify for the car and drive off with it today, but the math can be a bit staggering. Over the next 5 years, you will pay $4500 more for having that 650 score than you would have if you had a 720 score. Many car lenders will even give you lower rates if your scores are above 740 or 760!

Remember those wonderful negotiating skills you had? The lender just took back most of that “discount” you haggled so hard to get.

Oh but wait, it gets worse! How many cars do you have in your household? Two? Three? Did the same thing happen when you purchased all of those vehicles as well?

Can you escape this scenario by leasing your cars rather than buying them? NO! Leasing also involves financing and rates will go up when credit scores go down.

Unfortunately, some people find themselves in this situation over and over for years and years; consistently overpaying for far more than just cars, simply because their credit isn’t in the top tier.

The good news is that if you or someone you know is in this situation, it can almost always be fixed with about 4-6 months of credit repair. Sometimes even faster!! The investment is just a few hundred dollars – a fraction of the money that will be saved as a result of having higher credit scores. Call us today and keep more of your hard earned money in your pocket.