Why You Should Take Action to Remove Mortgage Lates from Your Credit Report

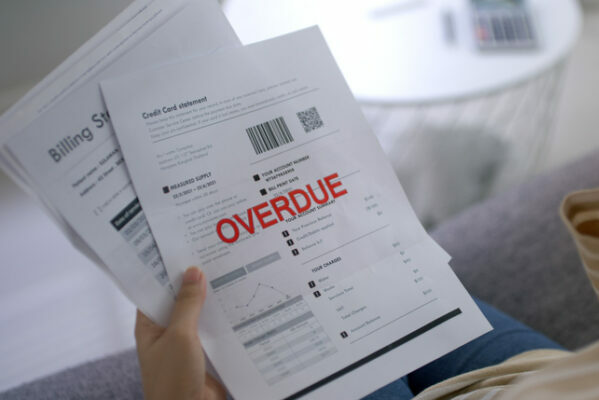

The pandemic and job losses that followed caused millions of Americans to be late on mortgage payments. In some cases it may have been just one late payment, in other cases it was multiple late payments or what is commonly called “rolling” late payments.

If those derogatory lates are still on your credit report, even if you have caught up on your delinquent payments or reached an agreement with your lender, they can have some severe consequences. In fact, even you have just ONE mortgage late payment on your credit, you could run into issues such as:

- Being declined for a mortgage loan the next time you want to purchase or refi your home.

- Having to pay a significantly higher interest rate on your next mortgage.

- Having drastically reduced credit scores stemming from the mortgage late that cause you to pay more for other types of financing such as cars and credit cards.

It’s easy to simply think that one mortgage late payment on your credit is “no big deal” especially if you’ve now brought your mortgage current or perhaps you’ve even sold the home and paid off the loan. Unfortunately, even just one late payment will follow you for several years and can negatively impact your finances for quite some time because most creditors and lenders really hesitate when they see a credit report with mortgage lates.

The smart move is to invest in a few months of credit repair, get that mortgage late removed from your credit report, and be free from the stigma that comes with mortgage late.

If your credit report shows mortgage lates, or if you even think that it might, give us a call and we’ll explain your options in a free, no-obligation consultation.