What are the Credit Tiers for Mortgage Rates?

You hear (and read) us preaching about how low to average credit scores will impact your finances, especially when it comes to large purchases like cars and homes. So today, let’s look at some real numbers pertaining to credit tiers and mortgage interest rates.

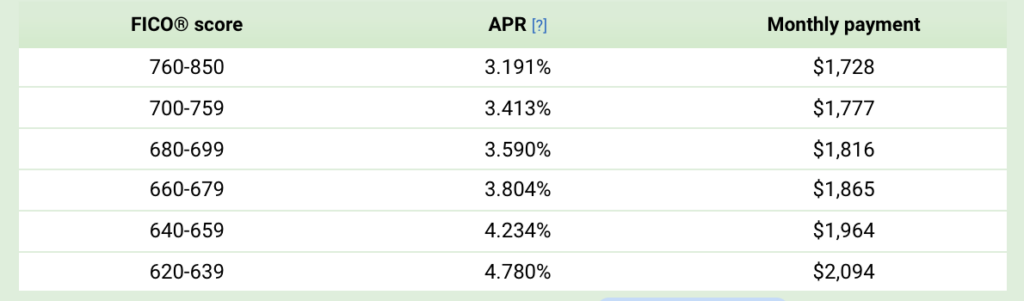

The table below shows you average mortgage rates based on your credit score. This information was gathered from MyFico.com on January 25, 2022, and it is based on a moderate loan amount of $400,000.

So as you will see, on a $400,000 loan (which would be considered small in Southern California), the payment difference between an average score of 675 and a top tier score of 775, is $137 per month. This means a person with average credit will pay $1644 more per year for the exact same house as someone with top tier credit.

If your credit scores are even lower, perhaps around 650, now that home will cost you $236 more each month ($2832/yr) than it costs someone with top tier credit.

Yes, you will probably find a lender who will approve your loan when your scores are in the lower tiers, but do you really want that loan and the higher payment?

This example illustrates why credit repair is so valuable for those with low to average credit. Elevating those credit scores into the higher tiers before you buy a house or a car will save you thousands of dollars each year!

But what if you already have a mortgage at a higher rate due to poor or average credit?

If you’re already paying higher rates, credit repair can move those scores up and allow you to refinance into a better loan. We will work with you and your lender to help make that happen.

If you have questions, please give us a call. A small investment into credit repair could make a big difference in your household finances.